- #BREAK EVEN POINT FORMULA WITH ONLY FIXED AND TOTAL COST HOW TO#

- #BREAK EVEN POINT FORMULA WITH ONLY FIXED AND TOTAL COST PLUS#

- #BREAK EVEN POINT FORMULA WITH ONLY FIXED AND TOTAL COST DOWNLOAD#

Put more succinctly, the break-even analysis is used to find your break-even point. What is a break-even analysis?Ī break-even analysis is an accounting process that determines the point at which a business investment will be on the verge of becoming profitable.

How to reduce your break-even point and reduce the time it takes to achieve profitability. The advantages and limitations of break-even analyses How to conduct a break-even analysis (in multiple ways) This is where break-even analysis comes in.

Thank you.Achieving profitability is a major milestone for any small business owner.īut, before you can focus on turning a profit, you need to focus on balancing out your revenues and your expenses. Kindly e-mail me your comments, suggestions, and concerns. All files are available at for mirroring. This site may be translated and/or mirrored intact (including these notices), on any server with public access. The Copyright Statement: The fair use, according to the 1996 Fair Use Guidelines for Educational Multimedia, of materials presented on this Web site is permitted for non-commercial and classroom purposes only.

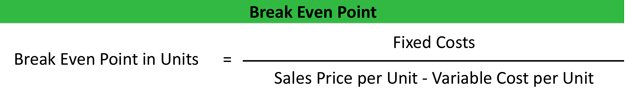

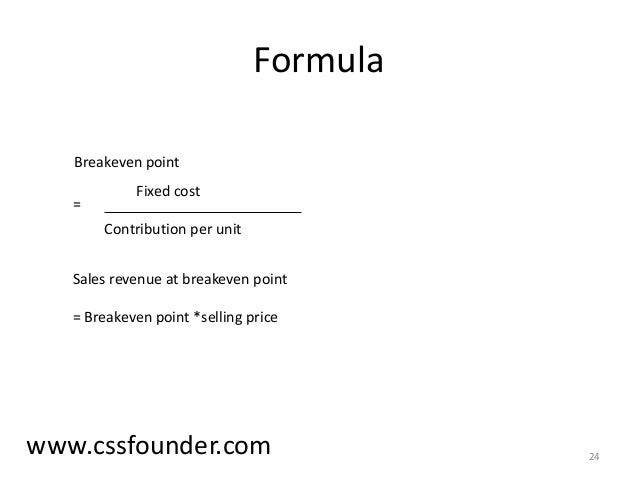

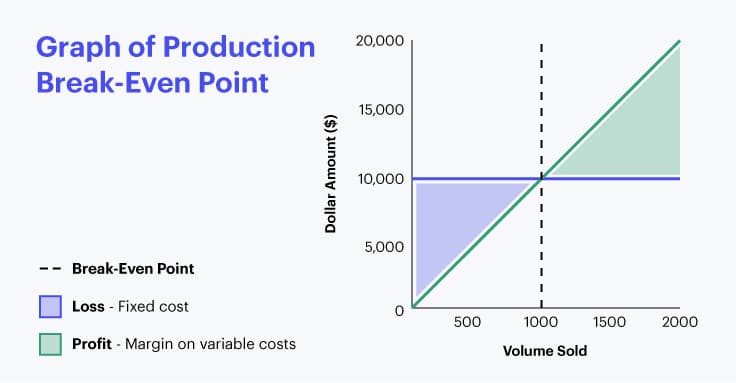

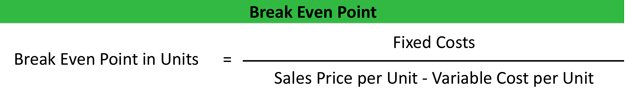

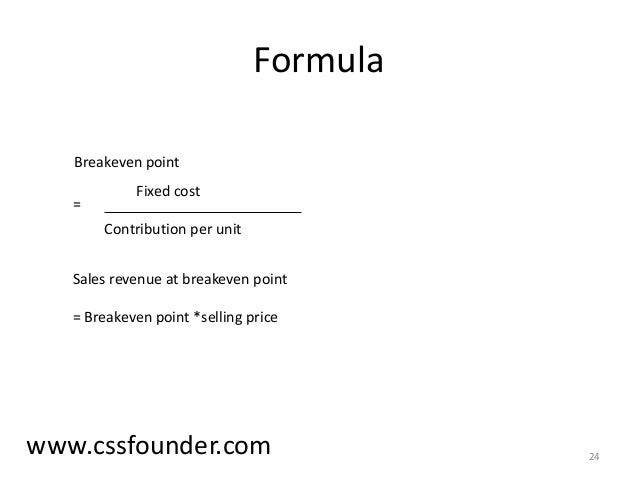

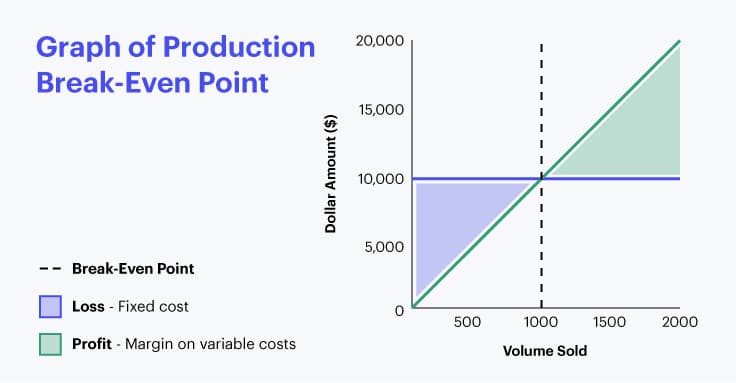

Test for Several Correlation Coefficients. K-S Test for Equality of Two Populations. Confidence Intervals for Two Populations. System of Equations, and Matrix Inversion. Maths of Money: Compound Interest Analysis. Linear Optimization Solvers to Download. Categorized Probabilistic, and Statistical Tools. Time-Critical Decision Making for Economics and Finance You may like using the JavaScript for performing some sensitivity analysis on the above parameters to investigate their impacts on your decision-making. Q = Break-even Point, i.e., Units of production (Q),īreak-Even Point Q = Fixed Cost / (Unit Price - Variable Unit Cost) However, the break-even point is found faster and more accurately with the following formula: The graphic method of analysis (below) helps you in understanding the concept of the break-even point. determining the financial attractiveness of different strategic options for your company.  targeting the "best" values for the variable and fixed cost combinations. setting price level and its sensitivity. One may use the JavaScript to solve some other associated managerial decision problems, such as: In other words, the break-even point is the point at which your product stops costing you money to produce and sell, and starts to generate a profit for your company. Number of units that must be sold in order to produce a profit of zero (but will recover all associated costs). Total Revenue: The product of forecasted unit sales and unit price, i.e., forecasted unit sales times unit price.

targeting the "best" values for the variable and fixed cost combinations. setting price level and its sensitivity. One may use the JavaScript to solve some other associated managerial decision problems, such as: In other words, the break-even point is the point at which your product stops costing you money to produce and sell, and starts to generate a profit for your company. Number of units that must be sold in order to produce a profit of zero (but will recover all associated costs). Total Revenue: The product of forecasted unit sales and unit price, i.e., forecasted unit sales times unit price. The sum of the fixed cost and total variable cost for any given level of production, i.e., fixed cost plus total variable cost. If any of the variables changes, the results may change. Enter Zero (0) if you wish to find out the number of units that must be sold in order to produce a profit of zero (but willĮach of these variables is interdependent on the break-even point analysis.

Forecasted Net Profit: Total revenue minus total cost. Total Variable Cost The product of expected unit sales and variable unit cost, i.e., expected unit sales times the variable unit cost.  Variable Unit Cost: Costs that vary directly with the production of one additional unit. Not vary as production increases or decreases, until new capital expenditures are needed. Total Fixed Costs: The sum of all costs required to produce the first unit of a product. Selling Price per Unit:The amount of money charged to the customer for each unit of a product or service. A firm's break-even point occurs whenĪt a point where total revenue equals total costs.īreak-even analysis depends on the following variables: The following JavaScript calculates the break-even point for a firm based on the information you provide.

Variable Unit Cost: Costs that vary directly with the production of one additional unit. Not vary as production increases or decreases, until new capital expenditures are needed. Total Fixed Costs: The sum of all costs required to produce the first unit of a product. Selling Price per Unit:The amount of money charged to the customer for each unit of a product or service. A firm's break-even point occurs whenĪt a point where total revenue equals total costs.īreak-even analysis depends on the following variables: The following JavaScript calculates the break-even point for a firm based on the information you provide.

0 kommentar(er)

0 kommentar(er)